New York, US:

A new wave of fraud is sweeping across New York, as residents report receiving letters and emails claiming to offer “inflation relief checks.” Authorities are warning that these so-called checks, which promise hundreds or even thousands of dollars in government-issued funds, are completely fake — and that unsuspecting New Yorkers could be losing thousands of dollars to the scam.

A Sophisticated Financial Trap

The scam appears to mimic official federal and state aid programs that were rolled out in recent years. Many of these fraudulent notices look legitimate, complete with government seals, stamp markings, and official-looking letterheads. Some victims have even reported receiving calls from fake “Department of Treasury” agents verifying their eligibility for the purported relief payment.

Also Read

According to consumer protection officials, these fraudsters are preying on financial anxiety caused by high living costs and inflation. With grocery prices, rent, and fuel costs still weighing heavily on many households, scammers are exploiting people’s hope for financial assistance.

How the Scam Works

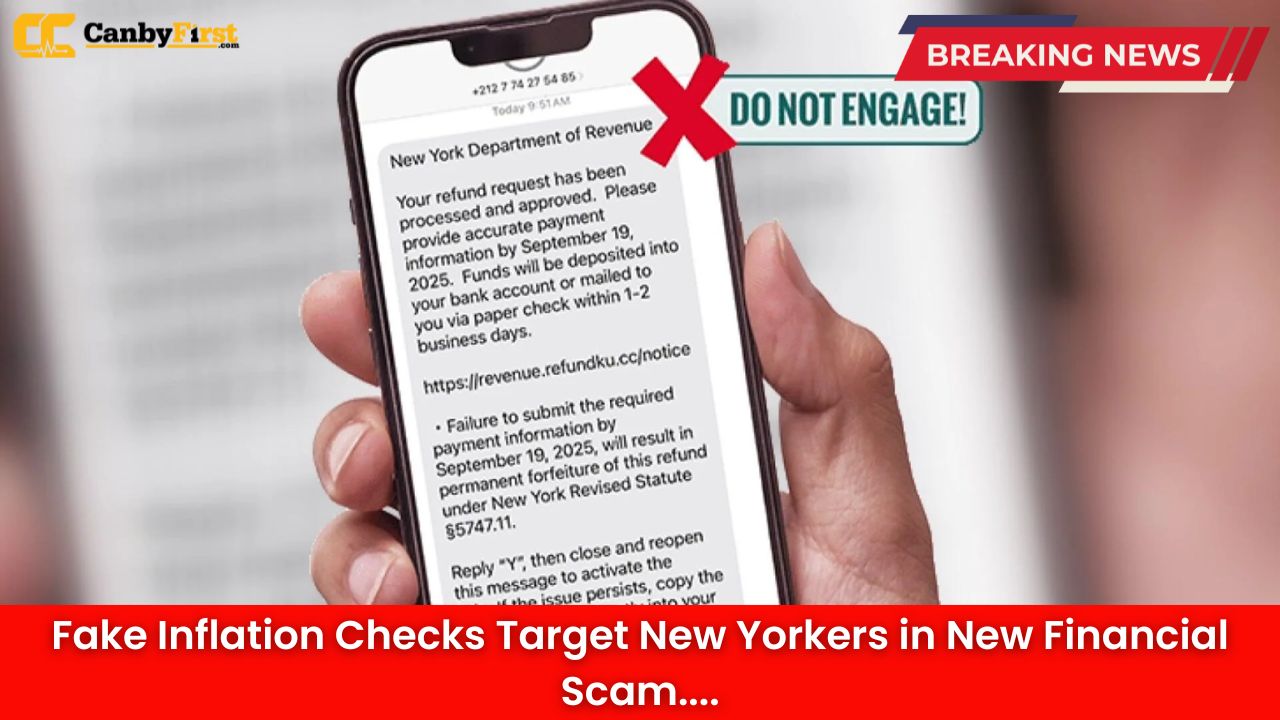

The scheme typically begins with an unsolicited message — a letter delivered by mail, a text, or an email — informing the recipient that they qualify for an “inflation adjustment payment” or “cost-of-living relief check.” The message then asks for personal or banking information to process the payment.

In some variants, victims receive a counterfeit check in the mail that looks authentic. Once deposited, the check initially appears to clear. The scammer then persuades the victim to send back a portion of the money — often framed as a “processing fee” or “tax withholding.” Days later, the bank flags the check as fraudulent, leaving the victim out of their own money.

Victims Losing Thousands

Local banks and law enforcement agencies have reported multiple cases in which residents lost significant sums, typically ranging from a few hundred dollars to over $5,000.

“I thought it was genuine because the letter had everything — even a signature from a supposed federal official,” said one victim from Queens who lost nearly $3,000. “They told me it was part of a new inflation support initiative. By the time I realized it was fake, the money was gone.”

Officials Issue Urgent Warnings

The New York Attorney General’s Office has issued an alert urging the public not to respond to unsolicited messages about inflation checks. Genuine government programs, they emphasized, will never ask for personal financial information via phone, email, or text.

Authorities also warn residents not to deposit unexpected checks or click on links claiming to offer government aid. Instead, they advise verifying such claims directly through official government portals.

“The scammers are getting smarter, but so should we,” said a spokesperson from the New York Department of Financial Services. “If something feels too good to be true — it probably is. The government doesn’t randomly send out money through unverified letters or text messages.”

Banks Join the Fight

Major banks have also stepped up their efforts to detect and warn customers about fake deposits and wire transfer requests. Many have started flagging suspicious checks that carry names of fictitious agencies like “The Office for Inflation Relief” or “Federal Inflation Reimbursement Division.”

Consumer advocates have called for stronger financial literacy campaigns, saying that these scams disproportionately target older adults and low-income individuals.

How to Stay Protected

New Yorkers can protect themselves by following key precautions:

-

Do not share personal or financial information over phone or email unless you have verified the source.

-

Be wary of unsolicited offers claiming to provide government “inflation relief” or “rebate” checks.

-

Avoid depositing unexpected checks, even if they appear legitimate.

-

Report any suspicious activity to your local bank, the Attorney General’s Office, or the Federal Trade Commission.

Experts recommend treating any unexpected financial offer with skepticism, especially when it requires immediate action or payment of fees.

The Broader Picture

Economic experts note that scams like this tend to spike during periods of financial uncertainty. Whether it’s stimulus payments, tax rebates, or inflation relief checks, fraudsters quickly adapt their tactics to mirror whatever legitimate aid programs are trending at the time.

“This isn’t just about one city or state,” said a cybersecurity analyst based in Manhattan. “Any financial relief initiative becomes a fresh opportunity for con artists. They replicate the government’s language, logos, and even timing — and by the time the real authorities respond, the scammers have already moved on.”

What’s Next for New York

Officials are pushing for increased coordination between state and federal agencies to track and shut down these fake check operations. There are also calls for tech companies, financial institutions, and postal services to enhance detection measures for fraudulent messages and counterfeit mail.

For now, the best defense remains public awareness. As inflation continues to strain household budgets, the need for vigilance has never been greater.

New Yorkers are being reminded that real government assistance programs are always publicly announced through official channels — and that the only “relief” scammers offer is a painful financial loss.

FAQs

1. What are fake inflation checks?

They are fraudulent payments sent by scammers claiming to be from government agencies offering inflation relief or cost-of-living compensation.

2. How do scammers use these fake checks?

They send counterfeit checks or messages to victims, who are then tricked into sharing banking information or sending back money after depositing fraudulent checks.

3. Are there legitimate inflation relief programs right now?

As of this time, there are no active federal or state “inflation relief check” programs in New York. Always verify such claims through official government sources.

4. What should I do if I get one of these letters?

Do not respond, deposit the check, or share your information. Report it immediately to local authorities or your bank.

5. Can banks recover the money if I fall for the scam?

In most cases, once the funds are transferred or withdrawn, recovery is difficult. Quick reporting, however, improves the chances of minimizing loss.