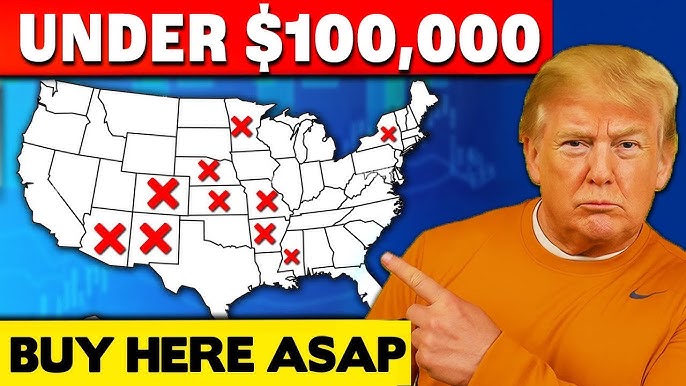

New York, US: In today’s volatile housing market, $100,000 might seem like pocket change compared to skyrocketing property prices in cities like New York or Los Angeles. Yet, across America, what that same amount of money can buy varies dramatically—and the results may surprise you. From sprawling homes in rural Midwest towns to small condos in coastal hubs, $100,000 stretches very differently depending on where you are.

The $100,000 Question in Major Cities

In major metropolitan hubs such as New York City, San Francisco, and Los Angeles, $100,000 in the housing market feels almost symbolic. In New York, for instance, that budget usually translates into a fraction of a down payment for an apartment, especially in Manhattan. Even in Brooklyn or Queens, where housing is relatively less expensive, $100,000 won’t buy you a property outright.

Los Angeles paints a similar picture. Homes in desirable areas average in the millions, meaning $100,000 is far from a full ticket to ownership. Instead, buyers in these areas often use it to secure financing or invest in very small studio spaces—sometimes even parking spaces are listed for similar price tags.

The Midwest Advantage

Travel a few states inland, and $100,000 suddenly tells a different story. In cities such as Cleveland, Detroit, or Indianapolis, the figure often means full ownership of a modest single-family home. For example, in Detroit, where recovery has been reshaping neighborhoods, $100,000 can still buy a fully functional house with multiple bedrooms, a yard, and sometimes even extra land.

In Cleveland, buyers may secure a cozy bungalow or a two-bedroom house in neighborhoods just outside the urban core. Indianapolis shows similar opportunities, where $100,000 can deliver a move-in-ready home with access to growing suburban amenities.

Southern States: Balancing Affordability

Across southern states, the $100,000 mark offers a delicate balance between affordability and limited urban access. In cities like Atlanta, Georgia, $100,000 might only reach condos or fixer-uppers within the city, but in outlying counties and small towns, this figure stretches to fully owned properties.

Texas stands out as well, though with variation. In cities such as Austin or Dallas, $100,000 is more of a down payment than a purchase price. But in smaller Texas towns—Waco or Lubbock, for example—a buyer might find modest traditional homes, mobile properties, or suburban units that need minimal renovations.

Coast-to-Coast Contrasts

Florida offers a unique twist to the $100,000 housing puzzle. In cities like Miami, the figure might only buy you a tiny studio or entry-level condo far from the waterfront. However, on the state’s Gulf Coast or inland regions, $100,000 goes further, often covering full mobile homes in retirement communities or small bungalows with backyard spaces.

On the opposite coastline, California serves as proof of dramatic housing disparities. While $100,000 is effectively unattainable for standalone homes in Los Angeles, San Francisco, or San Diego, further inland tells another story. In Central Valley towns, the same amount might secure a starter home, albeit often needing upgrades.

Rural Surprises

Perhaps the most surprising takeaway is how rural America transforms $100,000 into real buying power. In states like Kansas, Mississippi, or Arkansas, that figure can often secure multiple-bedroom homes with full yards, extra storage, and even farmland. These rural options offer lifestyle advantages that urban budgets cannot match—though they do come with limitations in job access and city amenities.

Even in places like upstate New York or the outskirts of Pennsylvania, $100,000 may purchase older homes ready for renovation, sometimes with expansive acreage included. For first-time buyers or those seeking vacation retreats, these rural deals are becoming attractive alternatives.

The Growing Divide

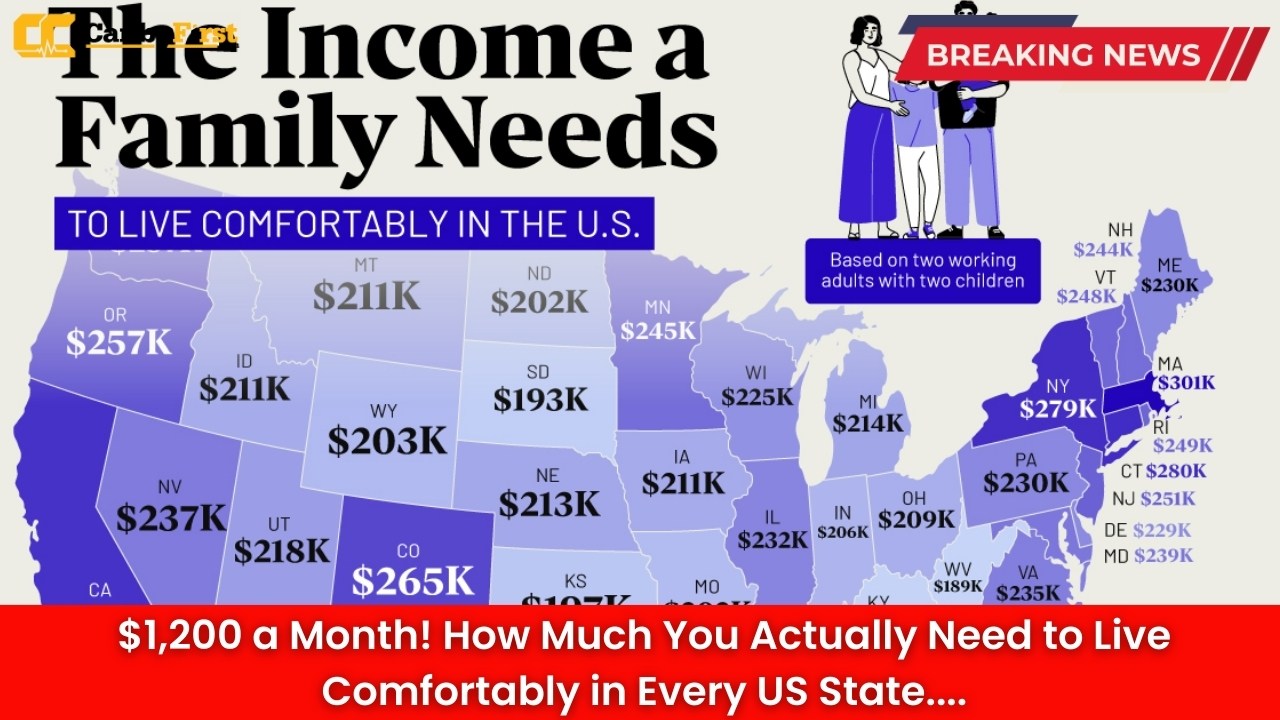

The differences in what $100,000 buys highlight not only regional market variations but also the growing housing affordability divide in the country. Urban markets continue pulling out of reach for average-earning families, leaving suburban and rural regions as prime targets for full ownership possibilities.

As Americans grapple with housing shortages and rising mortgage rates, many are asking whether owning in high-demand cities is realistic. Some are instead exploring opportunities in smaller towns where their money goes further, fueling a shift in urban-to-rural migration trends.

Final Thought

The question, “What does $100,000 buy in housing across America?” doesn’t have a single answer because location dictates value. In coastal cities, it may buy little more than a deposit or a cramped condo, while in small-town America, it may secure a full traditional home with space to grow.

With contrasts this stark, $100,000 becomes not just a number but a reflection of America’s housing divide—where your zip code matters far more than your budget.

Leave a Reply