EASTERN OREGON — Potato growers and processors in Oregon are bracing for financial turbulence as U.S. tariff hikes ripple through global trade markets, threatening one of the state’s most export-dependent agricultural sectors.

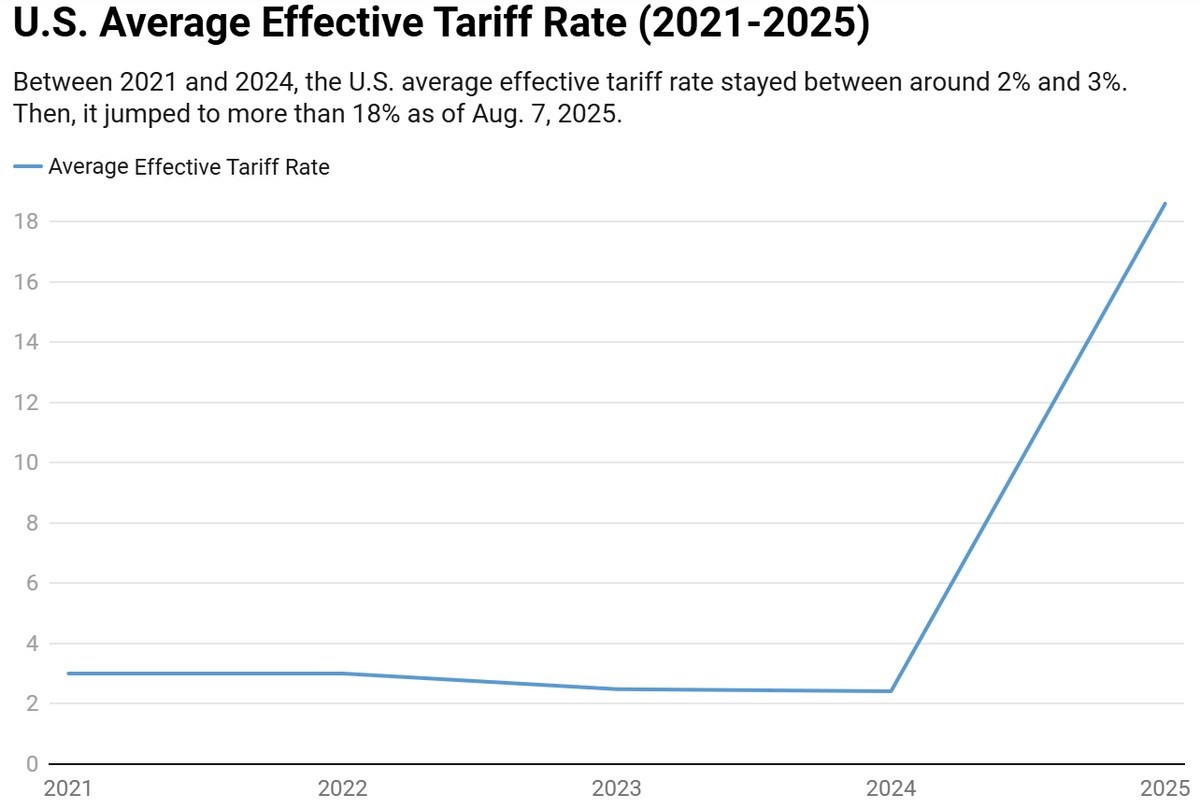

According to the Yale Budget Lab, the average U.S. effective tariff rate climbed to 18.6% as of Aug. 7—the highest since 1933. The Trump administration imposed the tariffs earlier this summer on nearly 80 countries and the European Union, a move that could reshape international demand for U.S. potatoes and drive up production costs at home.

Exports at Risk

Oregon is the nation’s fourth-largest potato-producing state, and more than half of its crop is exported. For now, growers say the immediate impacts have been muted.

“Growers have felt little to no immediate financial effects from the tariff increases on sales to processors,” said Gary Roth, executive director of the Oregon Potato Commission. He noted that farmers haven’t yet experienced major cost spikes in fertilizer and chemicals but cautioned the financial strain may surface in the next planting season when inputs are purchased.

“If the tariffs stay in place, I would anticipate that farmers will see increases in fertilizer cost,” Roth said, adding that some equipment invoices already list new tariff line items.

Fertilizer and Equipment Costs Rising

Local leaders are sounding alarms about production expenses. State Representative Bobby Levy said fertilizer prices have become “unsustainable” for Eastern Oregon farmers.

She cited Solution 32 fertilizer selling at $0.85 per pound, far above what she described as a sustainable level of $0.20–$0.30 per pound. Processors in Morrow County, she added, have reported equipment parts costs increasing by 5% to 15% over the past year.

For many growers, these price hikes threaten already thin margins, especially when paired with export uncertainties.

Economists Warn of Lost Markets

Economists say the longer-term risk lies in trade relationships. Damon Runberg, an economist with Business Oregon, warned that tariffs could push foreign buyers toward competing suppliers.

“What happens when we sever this relationship with certain export markets? How long will it take for us to rebuild those relationships, especially when there are alternatives that other countries are producing?” Runberg said.

Roth agreed, pointing to rising competition from abroad. “China is coming in with an increased supply. They’ve had a very intentional plan to increase their potato production over the last five years, and they are now competing with U.S. exports head-to-head,” he said.

Processors Brace for Added Costs

Major processors in Oregon are also preparing for tariff-related cost increases. Lamb Weston, which operates facilities in Hermiston and Boardman, told investors in July that tariffs were expected to add about $25 million in costs during its 2025/26 fiscal year, running from May 26, 2025, to May 31, 2026.

A company spokesperson confirmed that Lamb Weston would update its outlook in its Sept. 30 earnings call but declined to discuss mitigation strategies. The spokesperson noted that most ingredients used are either sourced domestically or exempt from tariffs, though certain oils imported from Asia may be affected.

Growing Uncertainty

While the immediate damage has not yet fully materialized, growers and processors alike are preparing for more expensive planting seasons and tighter profit margins. The combined pressure of rising input costs, disrupted trade flows, and foreign competition has cast a shadow over Oregon’s potato sector heading into the 2025/26 crop cycle.

Industry leaders say that much depends on whether tariffs remain in place. Short-term relief could stabilize costs, but prolonged trade disputes risk eroding Oregon’s competitive edge in global markets.

As Roth put it, “We export over half our crop. If we lose access to those markets, it won’t just be a short-term problem—it could take years to rebuild the relationships we’ve built with buyers around the world.”

The Road Ahead

For now, growers are watching closely as tariff impacts filter through supply chains. Economists warn that without resolution, Oregon’s potato industry could face both higher production costs and shrinking global demand.

The uncertainty leaves the state’s growers and processors in a precarious position: caught between maintaining their foothold in overseas markets and managing an increasingly expensive production environment at home.

Leave a Reply